The Inflation Picture

Sources: The Office for National Statistics; The Bank of England; Media reports on Citi Bank forecast;

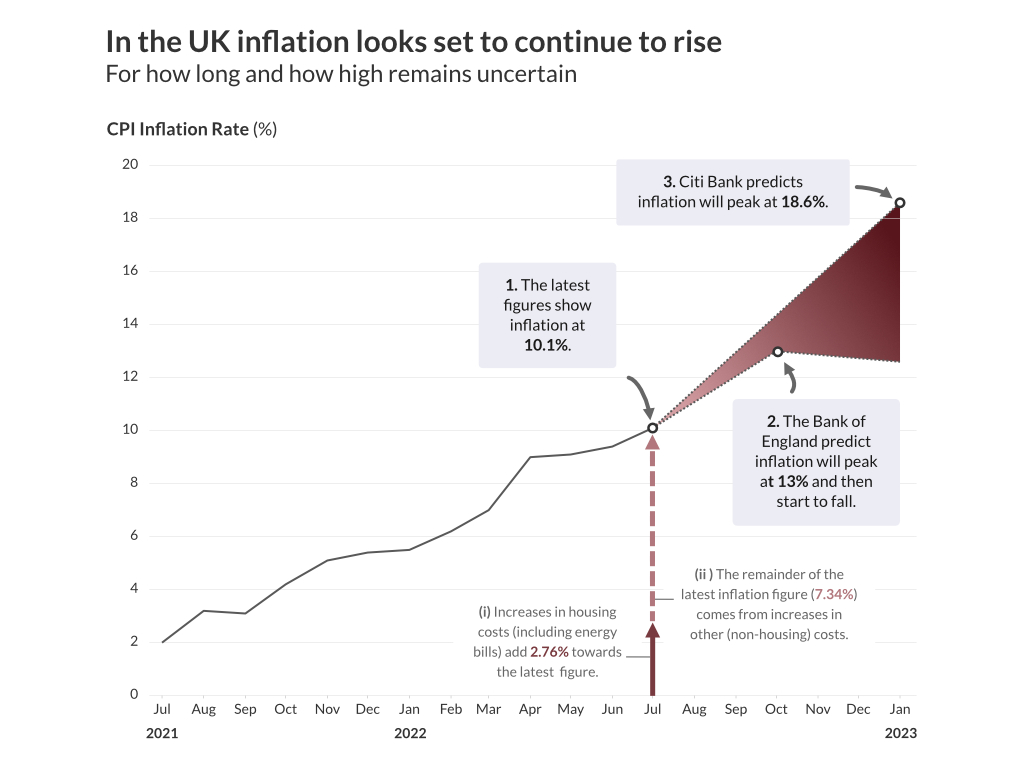

Inflation in the UK has risen rapidly over the last year due to energy prices increases, and a combination of other domestic and global factors. The phrase ‘cost of living crisis’ has become synonymous with the reduction in living standards caused by high and rapidly rising inflation.

The latest figures show inflation at 10.1% in July 2022, see explanation note 1 on the chart. A year earlier (July 2021) inflation was just 2%. The Bank of England are responsible for controlling inflation. They forecast that inflation will peak at 13% during the Autumn of 2022, see explanation note 2. Other financial institutions are less optimistic. Citi Bank forecast that inflation will peak at 18.6% early in 2023, see explanation note 3.

Rising prices across many sectors of the economy are driving inflation. The rising housing costs - including rents and energy costs –are at the heart of many people’s experience of the ‘cost of living crisis’. They add 2.76% towards the latest inflation figure (10.1%), see explanation note (i). The remainder of the latest inflation figure (7.34%) comes from increases in other (non-housing costs) including food, transport, clothing, recreation etc. see explanation note (ii).